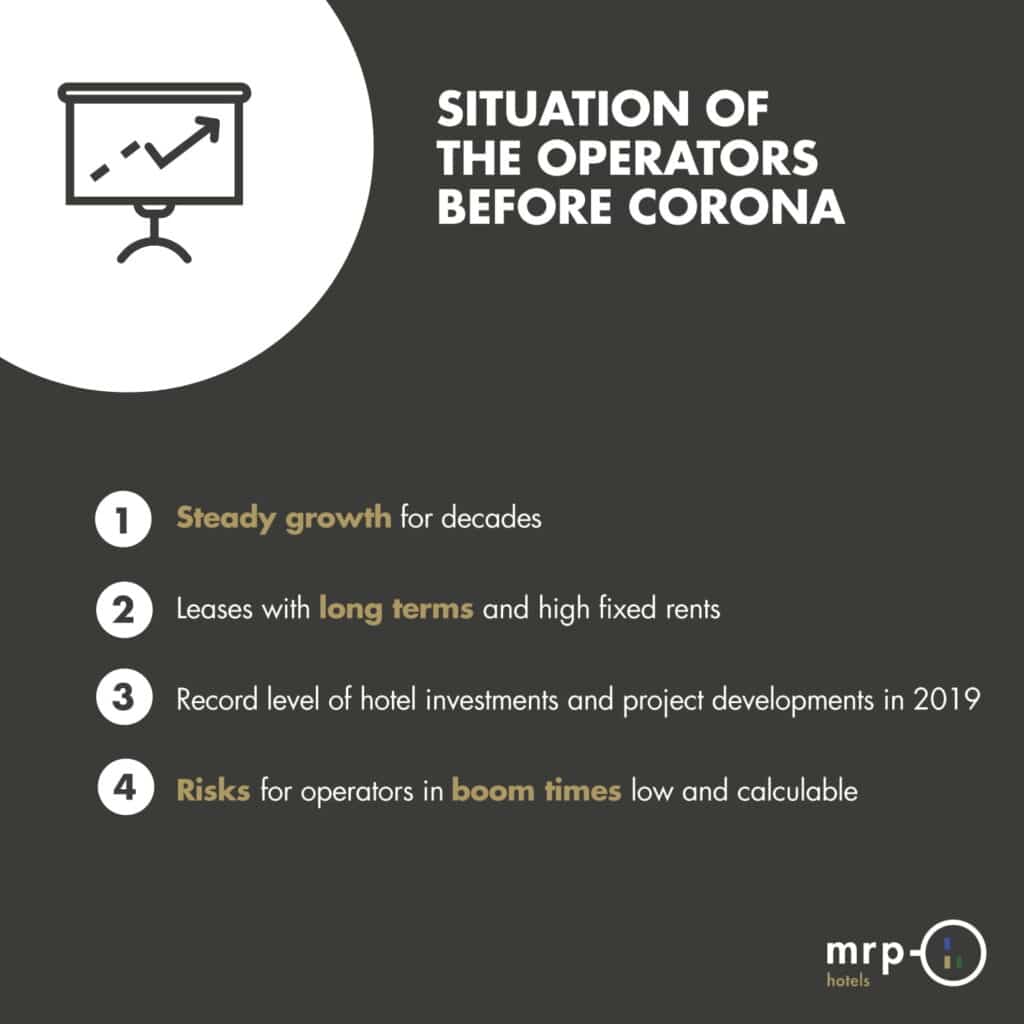

SITUATION FOR HOTEL OPERATORS BEFORE CORONA

Hotel operators were considered a growth industry worldwide until the beginning of 2020. In the past 20 to 30 years, exclusively growth has been recorded – a tenant and financing could be found for (almost) every hotel project.

The operator who could offer the highest fixed rent – and secure it to some extent – won the contract. New products, new operators and increasingly strong tourist hotspots (urban and rural) have led to a record number of investments and transactions. Lessees have often outbid each other on (fixed) leases to expand their market share. In making offers, they priced in a significant market growth that dominated at the time, which – contrary to expectations – is no longer occurring in many places today.

Until 2019, the risk in growing and simultaneously established markets was often manageable. A pandemic and a complete closure of hotel operations could not have been expected.

BEHAVIOUR DURING THE PANDEMIC

The lockdowns on the back of the Corona pandemic led to a state of shock. Operators were in survival mode and solely concerned with ensuring their liquidity. Renegotiating or suspending leases and filling out short-time work applications were at the forefront. In addition, head offices were shut down and in some cases development departments were closed. Operators were faced with massive ‘cash burning’. The last resort for survival was often to accept expensive government guarantees or to bring new investors on board, who now expect a high return on the capital invested.

Even before the outbreak of the Corona pandemic, international players increasingly relied on franchise agreements; management and lease agreements took a back seat for these companies. White label operators were interposed. Many of these are now ‘shaky candidates’ and, in the event of a sale, bring with them a penalty discount on the exit yield due to the increased risk.

Collateral and guarantees have become even more important than before. Fixed leases are avoided by operators where possible, yet they are essential for many (institutional) investors and banks. Only a few companies are currently able to deposit the required guarantees – however, they cannot conclude lease agreements for all hotels available on the market. Bankable operators are becoming rarer.

SITUATION TODAY

Staying ‘bankable’ is the new goal of many operating companies. Companies need to ensure their financing capability in order to a) secure ‘survival’ in a yet volatile market environment and b) at the same time obtain new bank guarantees in order to be able to push ahead with development.

The preparation and assessment of business plans is considered a challenge, as many parameters change quickly. The selection of the operator is more difficult than ever, as many operating companies still prove to be a black box. The strong increase in rents in the coming year will further drive the selection process.

The market suggests consolidation in the future. Those that can grow unencumbered by old leases and show good performances under current challenges and market conditions will remain the focus of investors.

Do you need support with your hotel property? Then you’ve come to the right place!

Here you will find a detailed breakdown of our services. Discover out services now!